The only Swiss Bachelor of Accounting and Finance with fully recognized qualifications for each year

The Swiss Bachelor of Accounting and Finance program offers a comprehensive foundation in business administration, specializing in financial management. It combines core business courses with advanced financial management modules, equipping students with skills in financial analysis, strategic decision-making, and corporate finance. Emphasizing critical thinking and ethical practices, the program prepares graduates for leadership roles in the financial sector, ready to tackle complex challenges in a global business environment.

Key Benefits of Fully Recognized Yearly Qualifications:

- Early Career Entry

- Financial Flexibility

- Increased Employability

- Career Security

- Global Recognition

- Academic and Professional Balance

- Flexibility in Progression

Along with globally recognized yearly qualifications, the SIMI Swiss program understands what bachelor’s students need:

- Fully Accredited & Recognized

- The Swiss Student Card confirms official Swiss student status and eligibility with SIMI Swiss

- Certified & Micro-Credentials Included

- Multiple Qualifications from SIMI & Prestigious Universities

- Stay updated with the latest trends

- Flexible Learning Model

- Expand your business network

- Academic Support While Studying

- Tuition fee support provided by Swiss EduFund

Qualifications & Professional Recognition within a Bachelor of Accounting and Finance Program:

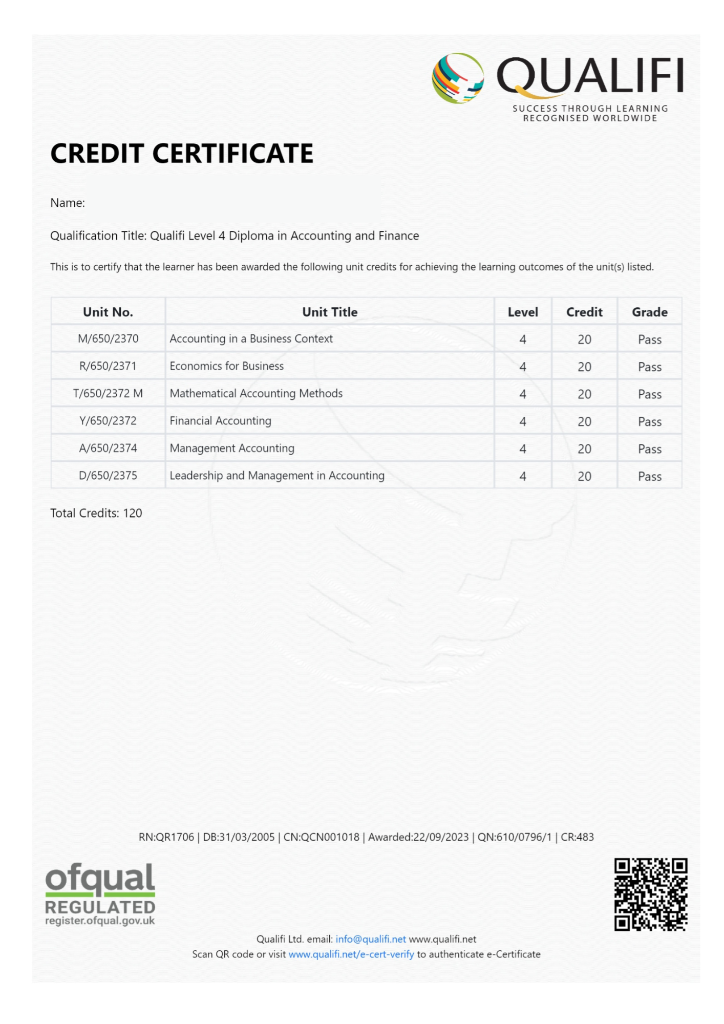

- Year 1: Qualifi Level 4 Diploma in Accounting and Finance (Gov Recognition No. 601/6048/2)

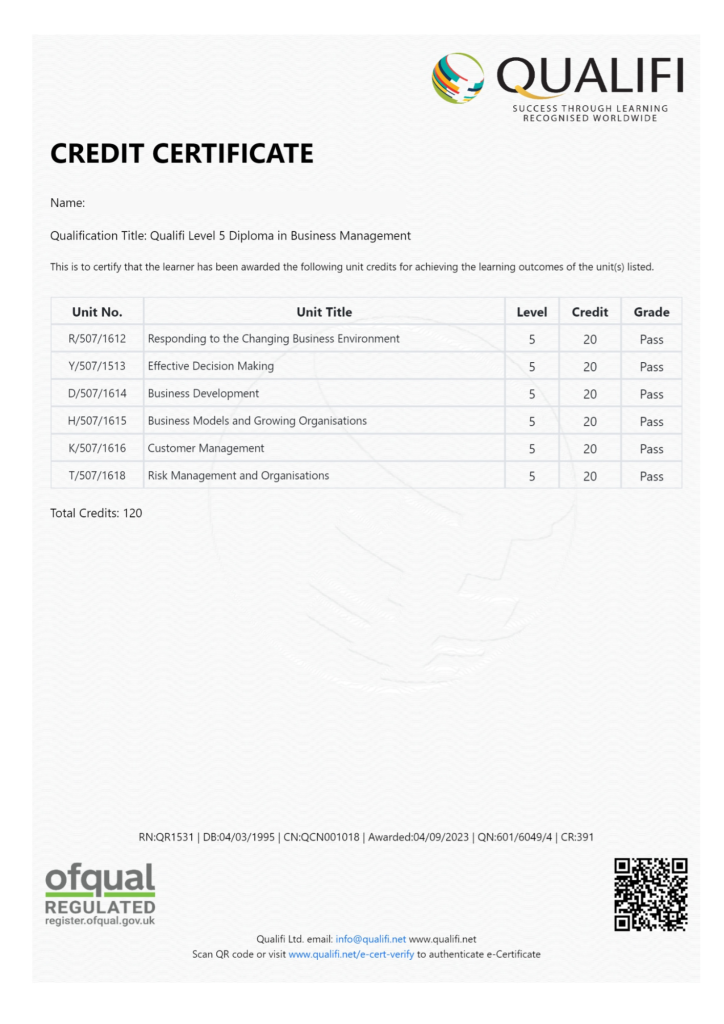

- Year 2: Qualifi Level 5 Diploma in Business Management (Gov Recognition No. 601/6049/4)

- Year 3: OTHM Level 6 Diploma in Business Management (Gov Recognition No. 603/2179/9)

- Final Stage: SIMI Swiss Bachelor of Business Administration (with Hons) in Bachelor of Accounting and Finance (Full Accreditation & Recognition HERE)

International Accreditation

SIMI is accredited at both the institutional and programmatic levels by ASIC, HEAD, ISO 21001:2018, OTHM, and Qualifi, which is recognized by Ofqual.

Multi Qualification

The program is widely recognized by the business community and partners, helping to optimize the use of the diploma after graduation.

30 Pro Recognize credentials

Learners earn 30 professional recognized certifications aligned with the European occupational framework, optimizing their skills upon graduation.

Academic & Research Support

The academic, research and language support system helps students overcome challenges so they can focus solely on excelling in their studies.

Learn and Earn

Year 1 Learn

1. Accounting in a Business Context (M/650/2370)

Overview

- Divided into three parts: communication theory, tools for effective communication, and application within organizations.

- Focuses on organizational communication channels, interpersonal communication, and the role of communication in decision-making.

Unit Aims

- Develop skills to improve communication practices within organizations.

- Understand how communication impacts performance and organizational culture.

Course Details

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning an Undergraduate Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

2. Economics for Business (R/650/2371)

Overview

- This unit focuses on macro- and micro-economic factors and their effects on businesses.

- Learners will assess how changes in economic conditions impact organizational decision-making and strategy.

- This unit focuses on macro- and micro-economic factors and their effects on businesses.

Learners will assess how changes in economic conditions impact organizational decision-making and strategy.

Unit Aims

- Develop an understanding of macro- and micro-economic factors affecting business.

- Analyze how these economic factors influence international business environments and organizational decisions.

Course Details

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning an Undergraduate Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

3.Mathematical Accounting Methods (T/650/2372)

Overview:

- This unit teaches the use of mathematical and statistical techniques in accounting to inform business decisions.

- Learners will create and interpret graphs, charts, and other diagrams to represent financial data.

- The unit emphasizes using statistical methods to provide meaningful financial information.

Unit Aims:

- Develop skills in applying mathematical techniques to accounting.

- Enhance the ability to create and interpret financial graphs and charts.

- Use statistical methods to represent and analyze financial data.

Course Details

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning an Undergraduate Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

4. Financial Accounting (Y/650/2373)

Overview:

- Learners will develop financial accounting skills, including inventory valuation and year-end adjustments.

- The unit covers the preparation of final accounts for sole traders and partnerships.

- Learners will gain a comprehensive understanding of financial statements and their preparation.

Unit Aims:

- Understand the valuation methods for stock and inventory.

- Learn how to prepare final accounts for businesses, including year-end adjustments.

- Develop the skills to assess the quality of financial statements.

Course Details

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning an Undergraduate Award from SIMI Swiss if taken independently.

5. Management Accounting (A/650/2374)

Overview:

- This unit focuses on management accounting techniques, including budgeting, costing, and capital expenditure appraisal.

- Learners will learn to analyze and evaluate financial data to support decision-making and organizational performance.

Unit Aims:

- Develop skills in preparing budgets and analyzing financial performance.

- Understand and apply costing techniques and capital expenditure appraisal.

Course Details:

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning an Undergraduate Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

6. Leadership and Management in Accounting (D/650/2375)

Overview:

- The unit examines leadership and management theories and their application in accounting.

- Learners will explore motivational theories, the dynamics of teamwork, and strategies for conflict resolution within accounting teams.

Unit Aims:

- Understand leadership and management theories in an accounting context.

- Explore motivational techniques and the role of teamwork in achieving organizational objectives.

Course Details:

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning an Undergraduate Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

Year 1 Earn

1. Get Qualifi Level 4 Diploma in Accounting and Finance

Upon completing program, students will receive:

- Qualifi Level 4 Diploma in Accounting & Finance - Qualification Number: 610/0796/1

Sample Level 4 Diploma:

Sample Level 4 Transcript:

2. Earn 10 Level 4 Pro Recognized e-Certificates

Upon completing the first year, students will receive 10 Level 4 Pro Recognized e-Certificates:

- Level 4 e-Certificate in The Business Environment: Explore external factors that affect businesses, including economics, international dimensions, nature, and competition.

- Level 4 e-Certificate in Managing and Using Finance: Understand key accounting areas and how they inform management decisions.

- Level 4 e-Certificate in Maximizing Resources to Achieve Business Success: Learn how to effectively manage resources for profitability.

- Level 4 e-Certificate in Quantitative Skills: Develop knowledge of numeric exercises and their application in business.

- Level 4 e-Certificate in Basic Accounting: Understand accounts and their use in assessing organizational health.

- Level 4 e-Certificate in Budgetary Control: Learn about financial control methods using budgets.

- Level 4 e-Certificate in Financial Performance: Assess financial performance using financial statements and accounting standards.

- Level 4 e-Certificate in Financial Ratios: Understand the application and meaning of common financial ratios.

- Level 4 e-Certificate in Financial Statements: Learn how to prepare and present financial statements.

- Level 4 e-Certificate in Further Ratios: Determine financial efficiency and assess future financial success.

Students can convert their e-certificates into hard copy certificates if needed (optional).

3. Gain competencies

The program equips learners with key competencies, including:

- Business Context: Understanding organizational structures and macro-environmental impacts on accounting.

- Financial Accounting: Preparing financial accounts, valuing inventory, and performing year-end adjustments.

- Management Accounting: Budgeting, costing, and capital expenditure appraisal.

- Mathematical & Statistical Methods: Applying mathematical techniques and statistical analysis to financial data.

- Professional Ethics: Understanding ethics, confidentiality, and regulatory compliance in accounting.

- Leadership & Management: Applying leadership theories and teamwork dynamics in accounting.

- Critical Thinking: Analyzing financial data and making informed decisions.

- Career Advancement: Preparing for further study or employment in accounting and finance.

4. Career Progression

A career in accounting and finance offers diverse pathways, including public accounting, financial consulting, corporate finance, and government roles. As businesses expand and regulations evolve, the demand for skilled finance professionals remains robust, offering job stability and significant growth opportunities.

"The program aligns with the Level 4 EQF competency framework, equivalent to 120 UK credits or 60 ECTS credits. It is recognized in most countries and territories, ensuring global acceptance and immediate employability."

Completing the Level 4 Diploma in Accounting & Finance qualifies learners for various entry-level positions in accounting and finance, such as:

- Accounts Assistant: Support the accounting team with tasks such as bookkeeping, managing invoices, and maintaining financial records.

- Junior Accountant: Assist in preparing financial statements, reconciling accounts, and handling general accounting tasks under supervision.

- Finance Assistant: Handle financial transactions, assist in budgeting, and manage financial data entry.

- Bookkeeper: Maintain accurate financial records, track expenses, revenues, and prepare reports for management.

- Payroll Administrator: Manage payroll processing, calculate wages, and ensure compliance with tax regulations.

- Credit Controller: Monitor overdue accounts, ensure timely payments, and communicate with clients to resolve payment issues.

- Tax Assistant: Assist in preparing tax returns and ensure compliance with relevant tax regulations.

- Management Accountant Assistant: Assist in budget preparation, cost management, and financial analysis for decision-making purposes.

- Financial Analyst (Junior): Analyze financial data, assist in investment planning, and support reporting activities.

- Audit Assistant: Support audit teams in reviewing financial statements, checking compliance, and ensuring accuracy in accounting records.

5. University progression

Upon completing this course, students can choose to pursue a Level 5 Diploma at the Swiss Information and Management Institute (SIMI). Additionally, students will have the opportunity to apply for admission to a full BA degree program at a range of universities in the EU and the UK.

Year 2 Learn

1. Responding to the Changing Business Environment (R/507/1612)

Overview:

- Examines factors influencing business environments: socio-economic changes, market dynamics, and relationships between business, government, and citizens.

- Focuses on how businesses can respond to changing environments and develop strategies to manage external threats and opportunities.

- Helps managers understand the importance of responding effectively to socio-economic shifts and government policies.

Unit Aims:

- Introduce learners to dynamic factors affecting organisational operations.

- Develop practical skills to manage relationships between business, government, and society.

Course Details

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning an Undergraduate Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

2. Effective Decision Making (Y/507/1513)

Overview:

- Explores decision-making models and processes used by organisations.

- Emphasizes incorporating stakeholder input and using information technologies in decision-making.

- Focuses on problem-solving, innovation, and participatory decision-making to enhance management practices.

Unit Aims:

- Develop an understanding of decision-making processes.

- Equip learners with tools for making informed, participatory decisions.

Course Details

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning an Undergraduate Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

3. Business Models and Growing Organisations (H/507/1615)

Overview:

- Examines business models and growth strategies for scaling organisations.

- Looks at challenges and opportunities for businesses at different stages of growth, and how to manage and optimise expansion strategies.

Unit Aims:

- Help learners understand factors that contribute to business growth.

- Develop skills to manage growth strategies and apply business models effectively.

Course Details

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning an Undergraduate Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

4. Customer Management (K/507/1616)

Overview:

- Focuses on customer relationship management (CRM) and practices for building, retaining, and enhancing customer relationships.

- Covers customer behaviour, segmentation, personalization, and strategies for improving customer satisfaction and loyalty.

Unit Aims:

- Provide insights into customer behaviour and equip learners with tools to manage customer relationships.

- Focus on CRM practices to enhance retention, satisfaction, and value for customers.

Course Details

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning an Undergraduate Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

5. Risk Management and Organisations (T/507/1618)

Overview:

- Introduces risk management from both organisational and individual perspectives.

- Discusses balancing risk and opportunity, with a focus on innovation and risk mitigation through strategic planning.

- Helps learners assess and manage risks in various industries.

Unit Aims:

- Provide understanding of risk management processes.

- Develop learners' ability to assess risk profiles and implement strategies to reduce risk while fostering innovation.

Course Details

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning an Undergraduate Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

Year 2 Earn

1. Get Qualifi Level 5 diploma in Business Management

Upon completing Year 2, students will receive:

- Qualifi Level 5 Diploma in Business Management - Qualification Number: 601/6049/4

Sample Level 5 Diploma:

Sample Level 5 Transcript:

2. Earn 10 Level 5 Pro Recognized e-Certificates

Upon completing the second year, students will receive 10 Level 5 Pro Recognized e-Certificates:

- Level 5 e-Certificate in The Entrepreneurial Manager: Explore the characteristics and skills of entrepreneurs, including innovation, risk-taking, leadership, and problem-solving.

- Level 5 e-Certificate in Organisational Structures: Understand the factors that influence organisational structure, such as size, industry, culture, and strategy.

- Level 5 e-Certificate in Practical Accounting Analysis: Analyse accounts to gain insights into financial performance, identify trends, and inform decision-making.

- Level 5 e-Certificate in Business Planning and Goal Setting: Develop clear goals and objectives for a business, create a strategic plan, and allocate resources effectively.

- Level 5 e-Certificate in Politics and Business: Explore the impact of political factors on business, including government policies, regulations, and economic conditions.

- Level 5 e-Certificate in Business Law: Understand the legal responsibilities of managers, including employment law, contract law, and corporate governance.

- Level 5 e-Certificate in Managing in Today’s World: Explore modern business practices, such as sustainability, corporate social responsibility, and ethical leadership.

- Level 5 e-Certificate in Performance Management: Improve employee and business performance through strategies such as performance reviews, goal setting, and training and development.

- Level 5 e-Certificate in Marketing and Sales Planning: Develop a comprehensive marketing and sales plan, including market research, target market identification, product positioning, and sales strategies.

- Level 5 e-Certificate in Quantitative Skills: Acquire knowledge of numeric exercises and their application in business, including financial analysis, data analysis, and statistical modelling.

Students can convert their e-certificates into hard copy certificates if needed (optional).

3. Gain competencies

Upon completing the first year, students will have acquired the following competencies and, along with the qualification received, will be ready to enter the workforce:

- Apply leadership principles in a business environment.

- Review and implement business management principles within industry settings.

- Utilize management principles in specific organizational environments.

- Enhance employability by connecting management theories to practical business applications.

- Utilize problem-solving techniques tailored to business and industry challenges.

- Select, analyze, and synthesize information from diverse sources.

- Demonstrate effective verbal and written communication skills.

- Work autonomously and collaboratively as part of a team.

- Manage personal development and continuous growth effectively.

4. Qualified for various positions

A Level 5 Diploma in Business Management typically prepares individuals for mid-level management and professional roles within various industries. Here are some qualified positions for someone with a Level 5 Diploma in Business:

- Assistant Department Head: Assists in managing department operations and supports the department head in supervisory responsibilities.

- Operations Coordinator: Coordinates daily operations, helping to ensure processes are efficient and organizational goals are met.

- Business Development Associate: Assists in identifying growth opportunities, supporting the development of strategic partnerships, and contributing to business expansion efforts.

- Project Lead: Leads smaller or segment-specific projects within larger initiatives, ensuring project components are executed on time and within scope.

- Marketing Coordinator: Supports the planning and execution of marketing strategies, managing specific campaigns, and helping to analyze market trends.

- HR Assistant Manager: Supports the HR management in handling recruitment, employee relations, and the implementation of HR policies.

- Sales Team Leader: Leads a sales team in daily activities, assisting in setting sales goals and strategies to enhance performance.

- Customer Service Supervisor: Oversees customer service operations within a team, focusing on maintaining high customer satisfaction levels.

- Junior Finance Officer: Supports financial operations including budgeting and financial planning, under the supervision of a senior finance officer.

These roles involve a higher level of responsibility and decision-making, often requiring a combination of practical experience and theoretical knowledge gained through the Level 5 qualification.

5. University progression

Upon completing this course, students can choose to pursue a Level 6 Diploma at the Swiss Information and Management Institute (SIMI). Additionally, students will have the opportunity to apply for admission to a full BA degree program at a range of universities in the EU and the UK.

Year 3 Learn

1. Leadership and People Management (H/616/2734)

Overview

- Divided into three parts: leadership theories, people management techniques, and their application.

- Focuses on leadership styles, team dynamics, motivation, conflict resolution, and employee engagement.

- Applies these concepts to real-world management challenges..

Unit Aims

- Develop leadership capabilities.

- Enhance understanding of people management practices to improve team performance and organizational effectiveness.

Course Details

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning a Bachelor Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

2. Business Research (K/616/2735 )

Overview

- Divided into three parts: understanding research methodology, applying research tools, and conducting a business research project.

- Covers qualitative and quantitative research methods, data collection tools, and business research project execution.

Unit Aims

- Develop research skills.

- Conduct rigorous business research that contributes to strategic decision-making and organizational development.

Course Details

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning a Bachelor Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

3. Operations Management (M/616/2736)

Overview

- Divided into three parts: key operations management concepts, resource management, and applying operations tools.

- Focuses on supply chain management, process optimization, quality control, and performance measurement.

Unit Aims

- Enhance understanding of operations management principles.

- Develop skills for optimizing processes, improving efficiency, and ensuring operational excellence.

Course Details

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning a Bachelor Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

4. Financial Decision Making (T/616/2737)

Overview

- Divided into three parts: core financial concepts, financial analysis tools, and real-world business applications.

- Covers financial statements, budgeting, cost analysis, and investment appraisal.

Unit Aims

- Equip learners with skills for making strategic financial decisions.

- Optimize financial performance to support business growth and sustainability.

Course Details

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning a Bachelor Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

5. Sustainable Business Practices (A/616/2738)

Overview

- Divided into three parts: core financial concepts, financial analysis tools, and real-world business applications.

- Covers financial statements, budgeting, cost analysis, and investment appraisal.

Unit Aims

- Enhance understanding of sustainability in business.

- Equip learners to design and implement sustainable practices that align with organizational goals.

Course Details

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning a Bachelor Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

6. Strategic Human Resource Management (F/616/2739)

Overview

- Divided into three parts: strategic HRM, HR practices, and real-world applications.

- Covers talent management, workforce planning, recruitment, training, and performance management.

Unit Aims

- Develop an understanding of the strategic role of HRM in business success.

- Equip learners with the skills to align HR strategies with organizational goals and foster a positive work culture.

Course Details

This course is accredited and mapped to National Occupational Standards. It can also be accumulated towards earning a Bachelor Award from SIMI Swiss if taken independently.

- View details on Learning Outcomes, Topics, and Suggested Readings HERE.

Year 3 Earn

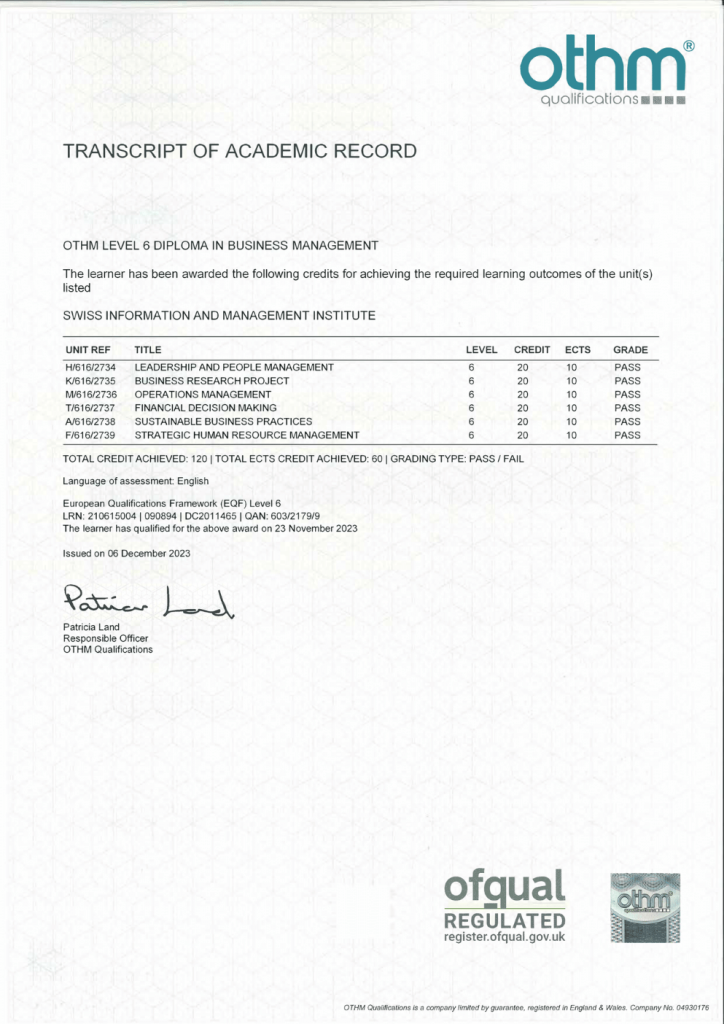

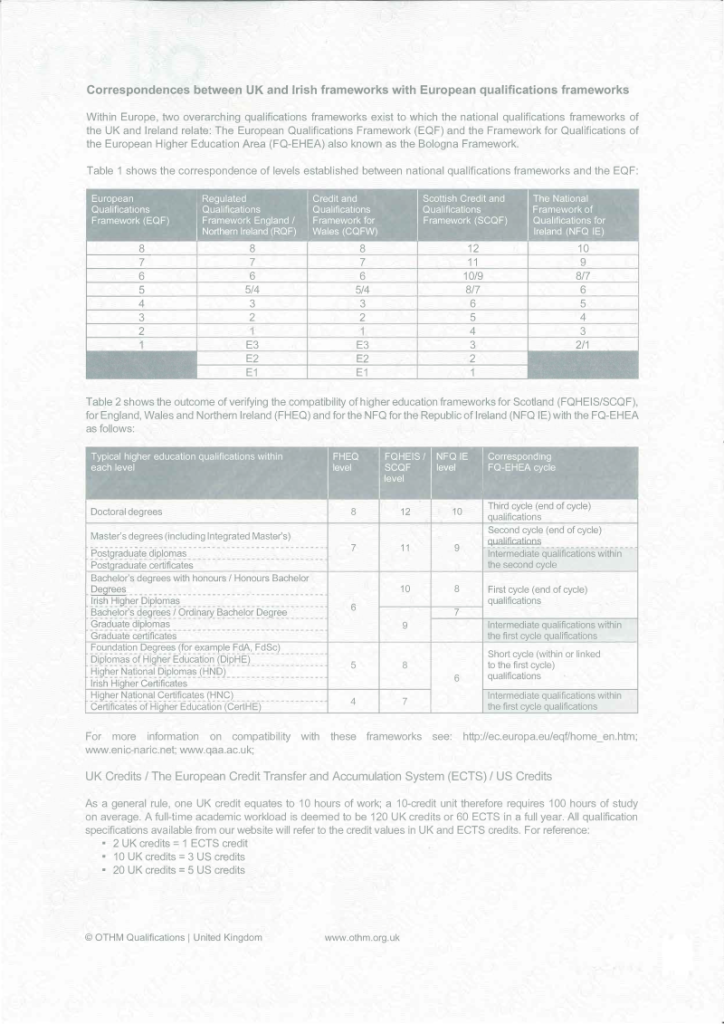

1. Get OTHM Level 6 diploma in Business Management

Upon completing Year 3, students will receive:

- OTHM Level 6 Diploma in Business Management - Qualification Number: 603/2179/9

Sample Level 6 Diploma:

Page 1 of sample diploma

Page 2 of sample diploma

Sample Level 6 Transcript:

Page 1 of sample transcript

Page 2 of sample transcript

2. Earn 10 Level 6 Pro Recognized e-Certificates

Upon completing the program, students will receive 10 Level 6 Pro Recognized e-Certificates:

- Level 6 in IT in Business: Evaluate the strategic role of IT in achieving competitive advantage.

- Level 6 in Effective Communication: Master communication strategies to enhance decision-making and collaboration.

- Level 6 in High-Performance Teams: Develop advanced team-building skills for cohesive and productive teams.

- Level 6 in Leadership Skills: Build adaptive leadership capabilities to navigate organizational challenges.

- Level 6 in Manager’s Toolkit: Learn versatile tools for analysis, problem-solving, and strategic planning.

- Level 6 in Managing and Using Finance: Understand finance’s role in guiding strategic decisions.

- Level 6 in Managing and Using Marketing: Create customer-centric strategies to deliver value and satisfaction.

- Level 6 in Managing Organizations: Explore how structure, culture, and management influence performance.

- Level 6 in Personal Effectiveness: Enhance productivity and self-leadership for impactful results.

- Level 6 in Quality and Excellence: Explore the meaning of quality and excellence in products, services, and organizational practices.

Students can convert their e-certificates into hard copy certificates if needed (optional).

3. Gain competencies

Upon completing the first year, students will have acquired the following competencies and, along with the qualification received, will be ready to enter the workforce:

- Strategic Management: Develop and implement strategies to achieve organizational objectives.

- Leadership Skills: Lead teams effectively in dynamic and competitive environments.

- Financial Decision-Making: Analyze financial data to inform strategic business decisions.

- Effective Communication: Master advanced communication techniques for stakeholder engagement.

- Marketing Strategies: Design and execute impactful marketing plans to drive business growth.

- Operational Management: Optimize processes and resources for efficient business operations.

- Problem-Solving and Decision-Making: Apply critical thinking to solve complex business challenges.

- Legal and Ethical Understanding: Navigate legal frameworks and ethical considerations in business.

- Research and Analysis: Conduct in-depth research to support evidence-based decisions.

- Organizational Development: Foster innovation, culture, and performance improvements.

4. Qualified for various positions

Upon completing a Level 6 RQF diploma with these competencies, learners would be qualified for various entry-level and junior management roles across multiple industries. Here are some potential positions:

- Business Supervisor: Oversee key elements of operations and strategy implementation while supporting broader organizational goals.

- Operations Coordinator: Coordinate and streamline processes to enhance daily business activities and efficiency.

- Marketing Specialist: Design and assist in the implementation of marketing strategies to boost brand performance.

- Finance Analyst: Analyze financial data, assist in budgeting and planning, and support decision-making processes.

- HR Specialist: Manage specific areas of talent acquisition and employee relations, supporting overall HR strategies.

- Project Coordinator: Assist in leading projects, ensuring they adhere to set objectives, budgets, and timelines.

- Planning Officer: Contribute to the development of long-term strategic plans to meet organizational goals.

- Team Supervisor: Lead and motivate teams to achieve specific performance targets, providing guidance and support.

- Business Advisor: Offer expert advice and recommendations in specialized areas such as operations, marketing, or finance to improve business outcomes.

These roles offer opportunities to further develop the skills acquired in the diploma and prepare for more senior positions over time.

Bachelor Final Stage Learn

Capstone Project

Overview

A Capstone Project is a comprehensive, final assignment that BBA students complete at the end of their program. It is designed to encapsulate the knowledge and skills they have acquired throughout their studies. Unlike traditional exams, a Capstone Project requires students to apply what they've learned to a real-world problem or challenge in their field.

Unit Aims

The capstone aims to provide students:

- Practical Application: The project typically involves solving a practical business problem, conducting research, or developing a strategic plan for a real or simulated organization.

- Integration of Knowledge: Students must integrate and apply concepts from multiple courses, demonstrating their ability to synthesize information and use it effectively in a professional context.

- Research Component: Often, a Capstone Project includes a significant research element, requiring students to gather, analyze, and interpret data to support their conclusions and recommendations.

- Collaboration: Some Capstone Projects are completed in teams, simulating the collaborative nature of real business environments. Others may be individual projects, allowing for a deep dive into a specific area of interest.

- Presentation and Defense: Upon completion, students typically present their project to a panel of faculty members or industry professionals, and defend their methodology, findings, and recommendations.

Benefits of a Capston Project:

- Real-World Experience: Students gain hands-on experience by working on actual business problems or scenarios.

- Skill Development: The project hones critical thinking, problem-solving, research, and communication skills.

- Portfolio Piece: The completed project can serve as a showcase of the student's capabilities, useful for job interviews or career advancement.

- Networking: Projects often involve collaboration with industry professionals, providing valuable networking opportunities.

In essence, a Capstone Project is the culmination of an BBA program, allowing students to demonstrate their expertise and readiness for professional challenges.

Bachelor Final Stage Earn

1. Get Bachelor of Business Administration (with Hons) in Accounting and Finance

The Capstone Project, as the culmination of their learning, will demonstrate learners' ability to apply theoretical knowledge to practical, real-world challenges. This not only enhances their academic credentials but also provides employers with a clear indication of their expertise in financial management.

To facilitate this, learners will select a major for their Capstone Project, allowing them to specialize in a specific area of financial management. This chosen major will be integrated into their academic progression and will be clearly reflected in their Bachelor of Business Administration (with Hons) in Accounting and Finance qualification, as well as the official transcripts issued by SIMI Swiss.

2. Gain competencies

Upon completing the Bachelor of Business Administration with Honours in Financial Management program, students will gain a wide range of competencies, including:

- Financial Analysis Skills: Ability to analyze and interpret financial statements, budgets, and forecasts to guide business decisions and ensure financial health.

- Strategic Financial Planning: Competence in developing and implementing strategic financial plans to drive organizational growth and profitability.

- Risk Management: Understanding of how to identify, assess, and mitigate financial risks to ensure the stability and longevity of a business.

- Corporate Finance Expertise: Knowledge of capital budgeting, investment decisions, and financial instruments to make informed corporate financial decisions.

- Leadership and Management Skills: Ability to lead teams, manage resources, and make decisions that align with organizational goals in a competitive environment.

- Business Ethics and Governance: A strong understanding of ethical considerations in financial management and the importance of corporate governance in maintaining integrity and accountability.

- Problem-Solving and Decision-Making: Enhanced ability to use critical thinking and quantitative analysis to solve complex financial challenges.

- Communication and Presentation Skills: Proficiency in presenting complex financial information to stakeholders in a clear and impactful manner.

- Global Financial Awareness: Understanding of the global financial environment, including the impact of international markets, trade, and regulations on financial decision-making.

- Research and Analytical Skills: Ability to conduct independent research, analyze data, and apply findings to real-world financial management issues.

3. Qualified for various positions

Graduates of the Bachelor of Business Administration with Honours in Financial Management program will be qualified for a variety of positions in both the public and private sectors. Some potential roles include:

- Financial Analyst: Analyzing financial data, preparing reports, and advising businesses on financial decisions.

- Corporate Finance Manager: Overseeing the financial health of an organization, managing budgeting, financial planning, and investment strategies.

- Financial Planner/Advisor: Providing personal financial advice, managing investments, and developing financial plans for individuals or organizations.

- Risk Manager: Identifying and managing risks to minimize potential financial losses for businesses or financial institutions.

- Management Accountant: Preparing financial statements, overseeing internal controls, and providing strategic guidance on financial operations.

- Treasury Manager: Managing an organization’s finances, including liquidity, investments, and risk management related to financial assets.

- Internal Auditor: Evaluating and ensuring the effectiveness of an organization's internal financial controls and compliance with laws and regulations.

- Business Consultant: Advising companies on financial strategies, performance improvements, and business growth initiatives.

- Investment Banker: Providing financial services related to corporate mergers, acquisitions, and capital raising activities.

- Chief Financial Officer (CFO): Leading the financial strategy of an organization, managing financial risks, and overseeing financial operations at an executive level.

Entry requirements & Learning methods

1. Entry Requirements

In addition to the entry requirements, candidates applying to the program are also assessed for their suitability by the admissions committee before joining the program to ensure that they can acquire and benefit from the program.

Entry requirements:

To enroll this program, learners must possess the criteria below:

- Attained a Level 3 Diploma under the NQF/QCF/RQF system or its equivalent.

English requirements:

If a learner is not from a predominantly English-speaking country, proof of English language proficiency must be provided.

- Common European Framework of Reference (CEFR) level B2 or equivalent;

- Or A minimum TOEFL score of 101 or IELTS 5.5; Reading and Writing must be at 5.5 or equivalent.

Please note:

- SIMI Swiss does not accept entry qualifications from counterfeit universities, Diploma Mills, or universities accredited by unreliable accreditation agencies.

- SIMI Swiss reserves the right to make admissions decisions based on the requirements of recognized agencies and the global quotas of the program.

3. Learning methods

The qualification is designed to be delivered over 4 academic years for full-time study, but it also offers a flexible model to accommodate part-time and distance learning options.

The qualification is delivered in the following modes:

1. On-campus Mode in Switzerland

- Blended Learning: Combines the benefits of traditional classroom instruction with the flexibility of online learning, allowing students to participate in in-person sessions on campus while also benefiting from digital resources such as online lectures, discussion forums, and virtual collaborative tools.

- Full-time Learning: Involves attending campus-based classes on a set schedule, allowing for closer interaction with professors, peers, and industry professionals. Students also have the opportunity to participate in various extracurricular activities, internships, and on-campus events, providing them with a well-rounded experience.

Learn more about SIMI Campuses [HERE]

2. Off-campus Mode:

The program combines Live Classes with lecturers and local tutors (where applicable) for a hybrid learning experience.

- Offering interactive, real-time engagement with instructors.

- Local tutors provide additional guidance to help learners apply theoretical concepts to practical scenarios (please note that local tutors only apply where SIMI has a scientific partner).

- Ideal for busy professionals seeking flexibility with personalized support.

Learn more about the overview of enrolling in online classes at SIMI Swiss [Video HERE]

Learn more about the effectiveness of SIMI Pedagogy [Video HERE]

3. Fully Online Mode:

The program is implemented using a combined automated training model that includes:

- Optimized Online Learning System: Designed to enhance the self-study process.

- Bite-Sized Lectures: Lessons are structured in short, manageable modules, enabling students to grasp the content immediately after completing each module.

- Comprehensive Support System: Provides students with the necessary tools and support to efficiently fulfil course requirements.

Learn more about how to use the automated training model at SIMI Swiss [Video HERE]

4. Academic Support

We understand that pursuing an accredited postgraduate program can be both exciting and challenging, especially for busy adult learners. To help you overcome these challenges, we’ve created the SIMI Swiss Supporting Systems, designed to guide you through any difficulties during your studies.

For a full overview of the support available, be sure to watch our informative videos, offering help at every stage of your academic journey.

Supplemental resources and Pro Certified

1. Supply 30 courses mapped to National Occupational Standards

The National Occupational Standard is a crucial benchmark that ensures educational programs meet workplace demands. The Bachelor of Accounting and Finance Swiss program is fully aligned with the Senior Leader position according to the national competency framework.

Beyond the comprehensive Bachelor of Accounting and Finance curriculum, students gain access to an additional 30 professional modules covering a wide range of specializations. This expanded knowledge base enables students to build on their classroom learning and directly apply it to their specific job roles and needs, offering valuable tools for professional growth.

Unlike other study materials, this interactive and exclusive set of resources, developed by SIMI Swiss, is specifically designed for self-study. The knowledge system, aligned with the National Occupational Standard, is divided into 30 knowledge groups, each further broken down into bite-sized lessons. This approach allows students to absorb content quickly and effectively, even when away from their computer or phone.

- Learn more about the National Occupational Standard system [HERE].

- Learn more about the exclusive pedagogy for the supplemental interactive study materials [HERE].

The 30 interactive courses that enhance knowledge and automatically accumulate 30 separate Master Pro Certifications include:

- Level 4 Pro-Certificate in Developing Personal Skills

- Level 4 Pro-Certificate in Effective Communication

- Level 4 Pro-Certificate in The Business Environment

- Level 4 Pro-Certificate in The Marketing Mix

- Level 4 Pro-Certificate in Strategic HRM

- Level 4 Pro-Certificate in Managing Ethically

- Level 4 Pro-Certificate in Culture and the Organization

- Level 4 Pro-Certificate in Customers and Customer Service

- Level 4 Pro-Certificate in Fundamentals of Accounting

- Level 4 Pro-Certificate in Financial Management and Control

- Level 5 Pro-Certificate in The Entrepreneurial Manager

- Level 5 Pro-Certificate in Organisational Structures

- Level 5 Pro-Certificate in Practical Accounting Analysis

- Level 5 Pro-Certificate in Business Planning and Goal Setting

- Level 5 Pro-Certificate in Politics and Business

- Level 5 Pro-Certificate in Business Law

- Level 5 Pro-Certificate in Managing in Today’s World

- Level 5 Pro-Certificate in Performance Management

- Level 5 Pro-Certificate in Marketing and Sales Planning

- Level 5 Pro-Certificate in Quantitative Skills

- Level 6 Pro-Certificate in IT in Business

- Level 6 Pro-Certificate in Effective Communications

- Level 6 Pro-Certificate in High Performance Teams

- Level 6 Pro-Certificate in Leadership Skills

- Level 6 Pro-Certificate in Manager’s Toolkit

- Level 6 Pro-Certificate in Managing and Using Finance

- Level 6 Pro-Certificate in Managing and Using Marketing

- Level 6 Pro-Certificate in Managing Organisations

- Level 6 Pro-Certificate in Personal Effectiveness

- Level 6 Pro-Certificate in Quality and Excellence

2. Supply 30 webinars mapped to National Occupational Standards

In addition to comprehensive lessons with built-in interactive activities and an exclusive self-study pedagogy, each knowledge module aligned with the National Occupational Standard includes instructional videos (webinars). BBA (Hons) in Majors students at SIMI Swiss are provided with 30 video webinars corresponding to the 30 interactive modules, ensuring a well-rounded and complete learning experience.

The 30 video webinars include:

- Webinar - Developing Personal Skills: Focuses on enhancing key personal skills for professional success and self-development.

- Webinar - Effective Communication: Explores communication techniques to improve both individual and group interactions in business.

- Webinar - The Business Environment: Examines the external and internal factors that influence business operations and decision-making.

- Webinar - The Marketing Mix: Covers strategies related to product, price, place, and promotion to drive marketing success.

- Webinar - Strategic HRM: Focuses on aligning human resource management practices with organizational strategy and goals.

- Webinar - Managing Ethically: Explores ethical principles and practices in business management and decision-making.

- Webinar - Culture and the Organization: Examines how organizational culture influences behavior, performance, and decision-making.

- Webinar - Customers and Customer Service: Provides insights into managing customer relationships and delivering exceptional service.

- Webinar - Fundamentals of Accounting: Introduces essential accounting principles and practices for business decision-making.

- Webinar - Financial Management and Control: Focuses on financial strategies and controls that ensure organizational financial health.

- Webinar - The Entrepreneurial Manager: Discusses skills and strategies for managing and leading entrepreneurial ventures.

- Webinar - Organisational Structures: Examines different organizational structures and their impact on management and operations.

- Webinar - Practical Accounting Analysis: Focuses on analyzing financial data to make informed business decisions.

- Webinar - Business Planning and Goal Setting: Teaches methods for creating effective business plans and setting strategic goals.

- Webinar - Politics and Business: Explores the relationship between politics, government policies, and business operations.

- Webinar - Business Law: Provides an understanding of the legal environment affecting business practices and decision-making.

- Webinar - Managing in Today’s World: Focuses on modern challenges in management, including globalization and technology.

- Webinar - Performance Management: Examines techniques for managing and improving employee performance to align with business goals.

- Webinar - Marketing and Sales Planning: Teaches how to create marketing and sales strategies that drive growth and profitability.

- Webinar - Quantitative Skills: Develops analytical skills using quantitative methods for business decision-making.

- Webinar - IT in Business: Explores the role of information technology in enhancing business efficiency and decision-making.

- Webinar - Effective Communications: Focuses on improving communication in business, emphasizing clarity and influence.

- Webinar - High Performance Teams: Discusses strategies for building and leading high-performing teams in organizations.

- Webinar - Leadership Skills: Focuses on developing essential leadership skills for managing teams and organizations.

- Webinar - Manager’s Toolkit: Introduces key management tools and techniques for effective decision-making and problem-solving.

- Webinar - Managing and Using Finance: Teaches how to effectively manage financial resources for business success.

- Webinar - Managing and Using Marketing: Focuses on applying marketing strategies to enhance business growth and customer engagement.

- Webinar - Managing Organisations: Examines strategies for managing organizational structure, culture, and operations.

- Webinar - Personal Effectiveness: Focuses on improving personal productivity and effectiveness in a professional setting.

- Webinar - Quality and Excellence: Explores the principles of quality management and achieving excellence in business processes.

3. Earn 30 Undergraduate Pro Certifications via automated testing

While an Bachelor degree certifies academic achievement at the Bachelor's level, in the workplace, Undergraduate Pro Certifications help professionals demonstrate their knowledge, skills, and ability to take responsibility in their specific fields.

As a program mapped to National Occupational Standards, along with the supplemental knowledge system, students can engage in self-study through interactive lessons, attend webinars, and take online tests to earn 30 Undergraduate Pro Certifications. Each ProCert reflects Level 4,5,6 (Undergraduate Level), outlines the Learning Outcomes, and provides certification upon completion.

If students wish to convert their e-Undergraduate Pro Certifications to hard copies, they can use an optional service for a minimal fee.

The 30 Undergraduate ProCerts that learners can obtain during the Bachelor Swiss program (note: this is optional):

- Level 4 Pro-Certificate in Developing Personal Skills

- Level 4 Pro-Certificate in Effective Communication

- Level 4 Pro-Certificate in The Business Environment

- Level 4 Pro-Certificate in The Marketing Mix

- Level 4 Pro-Certificate in Strategic HRM

- Level 4 Pro-Certificate in Managing Ethically

- Level 4 Pro-Certificate in Culture and the Organization

- Level 4 Pro-Certificate in Customers and Customer Service

- Level 4 Pro-Certificate in Fundamentals of Accounting

- Level 4 Pro-Certificate in Financial Management and Control

- Level 5 Pro-Certificate in The Entrepreneurial Manager

- Level 5 Pro-Certificate in Organisational Structures

- Level 5 Pro-Certificate in Practical Accounting Analysis

- Level 5 Pro-Certificate in Business Planning and Goal Setting

- Level 5 Pro-Certificate in Politics and Business

- Level 5 Pro-Certificate in Business Law

- Level 5 Pro-Certificate in Managing in Today’s World

- Level 5 Pro-Certificate in Performance Management

- Level 5 Pro-Certificate in Marketing and Sales Planning

- Level 5 Pro-Certificate in Quantitative Skills

- Level 6 Pro-Certificate in IT in Business

- Level 6 Pro-Certificate in Effective Communications

- Level 6 Pro-Certificate in High Performance Teams

- Level 6 Pro-Certificate in Leadership Skills

- Level 6 Pro-Certificate in Manager’s Toolkit

- Level 6 Pro-Certificate in Managing and Using Finance

- Level 6 Pro-Certificate in Managing and Using Marketing

- Level 6 Pro-Certificate in Managing Organisations

- Level 6 Pro-Certificate in Personal Effectiveness

- Level 6 Pro-Certificate in Quality and Excellence

Check out the way you could get 30 electric Undergraduate Professional Certified [Video HERE]

Program accreditations

1. Accreditation review guidelines by SIMI Swiss

SIMI is the first higher education institute in Zug, Switzerland, to achieve comprehensive international accreditations at both the organizational and program levels. The video below guides you through the step-by-step process of verifying and checking SIMI Swiss's accreditations and recognitions. All MBA Swiss programs, owned by SIMI Swiss, benefit from these quality standards.

2. Refer to SIMI Swiss information in SVEB Switzerland

SVEB Switzerland (Schweizerischer Verband für Weiterbildung) is the Swiss Federation for Adult Learning and serves as the national umbrella organization for adult education in Switzerland. SVEB is recognized as the leading authority in Switzerland for promoting and supporting lifelong learning and professional development through a wide range of educational programs and certifications.

Benefits of the SIMI Programs Published in SVEB:

- National & Federal Recognition: Being published in SVEB gives the SIMI Swiss program official recognition in Switzerland, validating its quality and adherence to Swiss educational standards.

- Increased Credibility: Membership and listing with SVEB enhance the credibility of the SIMI Swiss program, making it more attractive to prospective students and employers who value SVEB-approved programs.

- Professional Advancement: Programs listed with SVEB are often aligned with the needs of the Swiss job market, increasing graduates' employability and supporting their career progression within Switzerland.

- Access to a Wider Network: Association with SVEB connects the SIMI Swiss program to a broader network of educational institutions, professionals, and employers across Switzerland, offering opportunities for collaboration, networking, and knowledge exchange.

- Compliance with Swiss Standards: SVEB ensures that SIMI Swiss programs meet high educational standards, including up-to-date content, qualified instructors, and effective teaching methods, enhancing the overall learning experience for students.

- Support for Lifelong Learning: SVEB’s focus on adult education means the SIMI program aligns with lifelong learning principles, supporting students in their ongoing professional development.

Check the SIMI Swiss programs on SVEB HERE.

3. Accreditation of Level 6 Diploma in Business Management of OTHM

The Bachelor in Accounting & Finance program at SIMI Swiss offers a dual degree in partnership with OTHM, the Ofqual UK.Gov awarding body:

- Recognized as an organization by the educational authority of the United Kingdom, Ofqual (UK.Gov). Recognition Number: RN5284. Refer to the recognition information CLICK HERE

- OTHM Level 6 Diploma in Business Management is accredited with the Ofqual UK.Gov code 603/2179/9. Refer to the accreditation information CLICK HERE

Reference:

- Guidelines of how to check the recognition of OTHM: CLICK HERE

- Why Level UK offers optimal educational effectiveness for learners?: CLICK HERE

- The meaning of Level System in the labor market in the context of global labor mobility: CLICK HERE

- The meaning of Level System in global diploma recognition: CLICK HERE

You will get

Dual Bachelor

30 Pro Recognized

Swiss Student Card

Academic Support

Update Trend

All Undergraduate Programs

Fully Accredited

Multi Recognition

Bachelor of Business Administration (For Individual with Experience)

Powered by BizSchool of Zug

Bachelor of Business Administration

Powered by BizSchool of Zug

Bachelor of Entrepreneurship and Management

Powered by BizSchool of Zug

Bachelor of IT and Computing

Powered by IT Institute of Switzerland

Bachelor IT and E-commerce

Powered by IT Institute of Switzerland

Bachelor of IT and Networking

Powered by IT Institute of Switzerland

Bachelor of IT and Web Design

Powered by IT Institute of Switzerland

Bachelor of Accountant & Finance

Powered by BizSchool of Zug

Bachelor of Health & Social Care Management

Powered by Swiss Healthcare School

Bachelor of Bachelor of Tourism & Hospitality Management

Powered by Hospitality School

Bachelor of Teaching & Learning

Powered by Swiss EduSchool

Bachelor of Logistics and Supply Chain Management

Powered by LSCM Switzerland